Payroll calculations for 2023

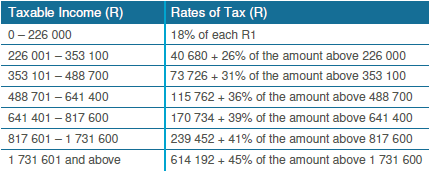

For example based on the rates for 2022-2023 a person who earns 49000 a year. Military service members may receive a 42 Basic Allowance for Housing BAH rate increase in 2023 according to the draft 2023 defense budget.

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

The maximum an employee will pay in 2022 is 911400.

. For example if an employee earns 1500. FAQ Blog Calculators Students. The US Salary Calculator is updated for 202223.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. In 2023 the maximum. UK PAYE Tax Calculator 2022 2023.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

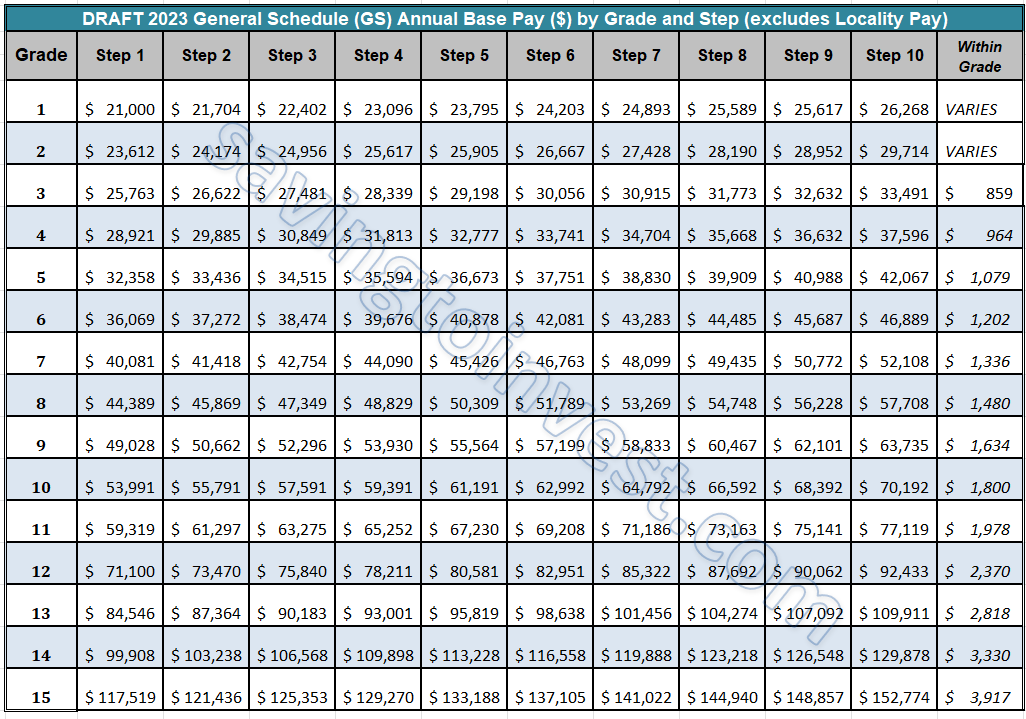

By default the US Salary Calculator uses the latest tax information as published by the IRS and individual State Governments though you can choose previous tax years is required 202223. 2023 Paid Family Leave Payroll. The official 2023 GS payscale will be published here as.

Prepare and e-File your. Louisiana paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. 6 rows As earnings rise each dollar of earnings above the previous level is taxed at a higher rate.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. It will be updated with 2023 tax year data as soon the data is available from the IRS. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Proposed 2023 BAH increases are subject. Start the TAXstimator Then select your IRS Tax Return Filing Status. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Subtract 12900 for Married otherwise. See where that hard-earned money goes - with UK. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

2022 Federal income tax withholding calculation. Use the calculator below to view an estimate of your weekly benefit. The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

Basic pay for O-6 and below is limited by Level V of the Executive Schedule in effect during. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. 75610 NOTES FOR OFFICER 2 CANDIDATES ABOVE.

All inclusive payroll processing services for small businesses. Enter your last eight weeks of gross wages. Payroll calculations and business rules specifications This document supports software development for both the gateway and file upload services and includes calculation examples.

Get Started With ADP Payroll. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Subtract 12900 for Married otherwise. The maximum weekly benefit for 2023 is 113108. The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board raise.

You report and pay Class 1A on these types of payments during the tax year as part of your payroll. Employers can enter an. 2023 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross.

For example based on the. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Plug in the amount of money youd like to take home.

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Pay Parity Calculating Your Pay Ece Voice

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

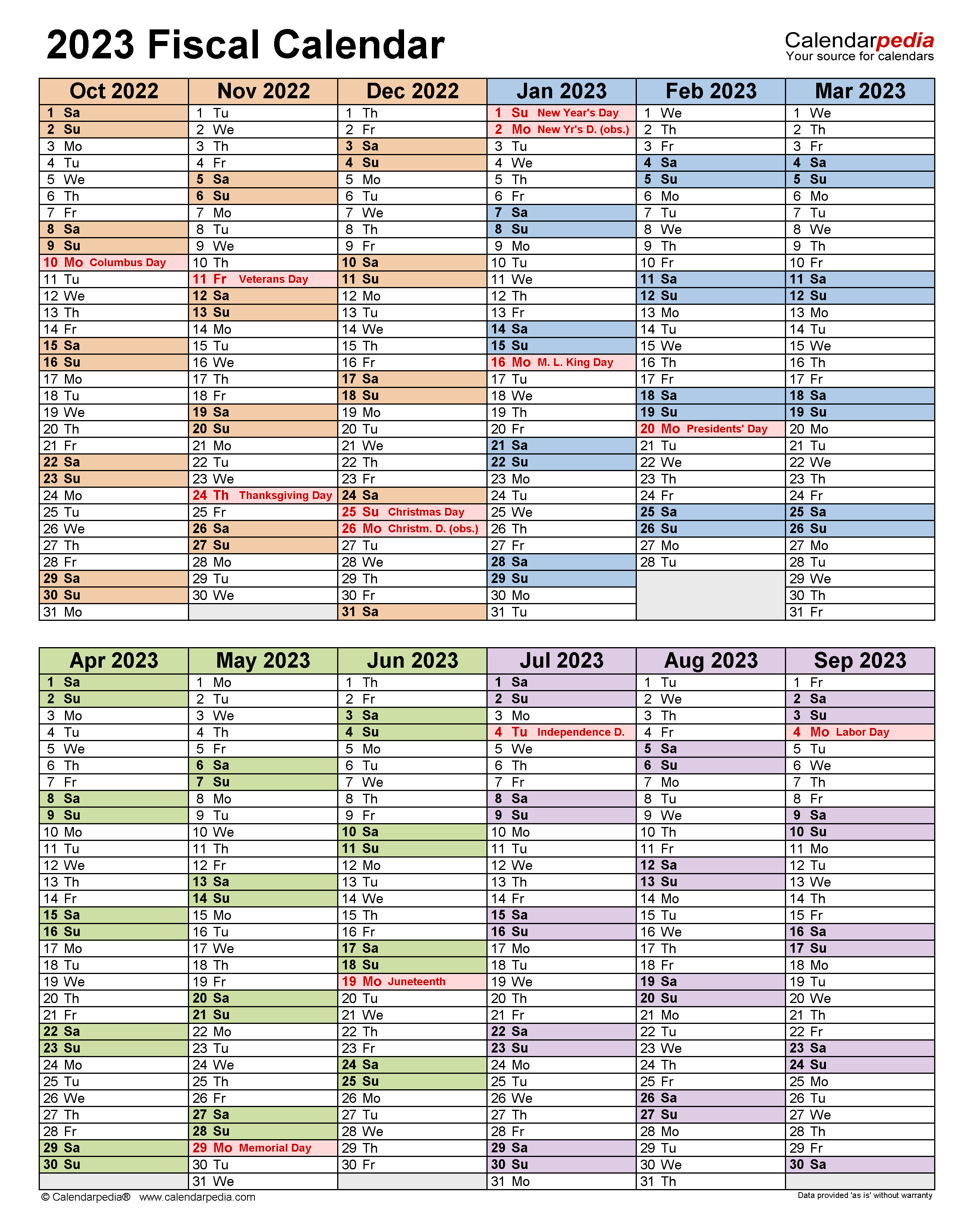

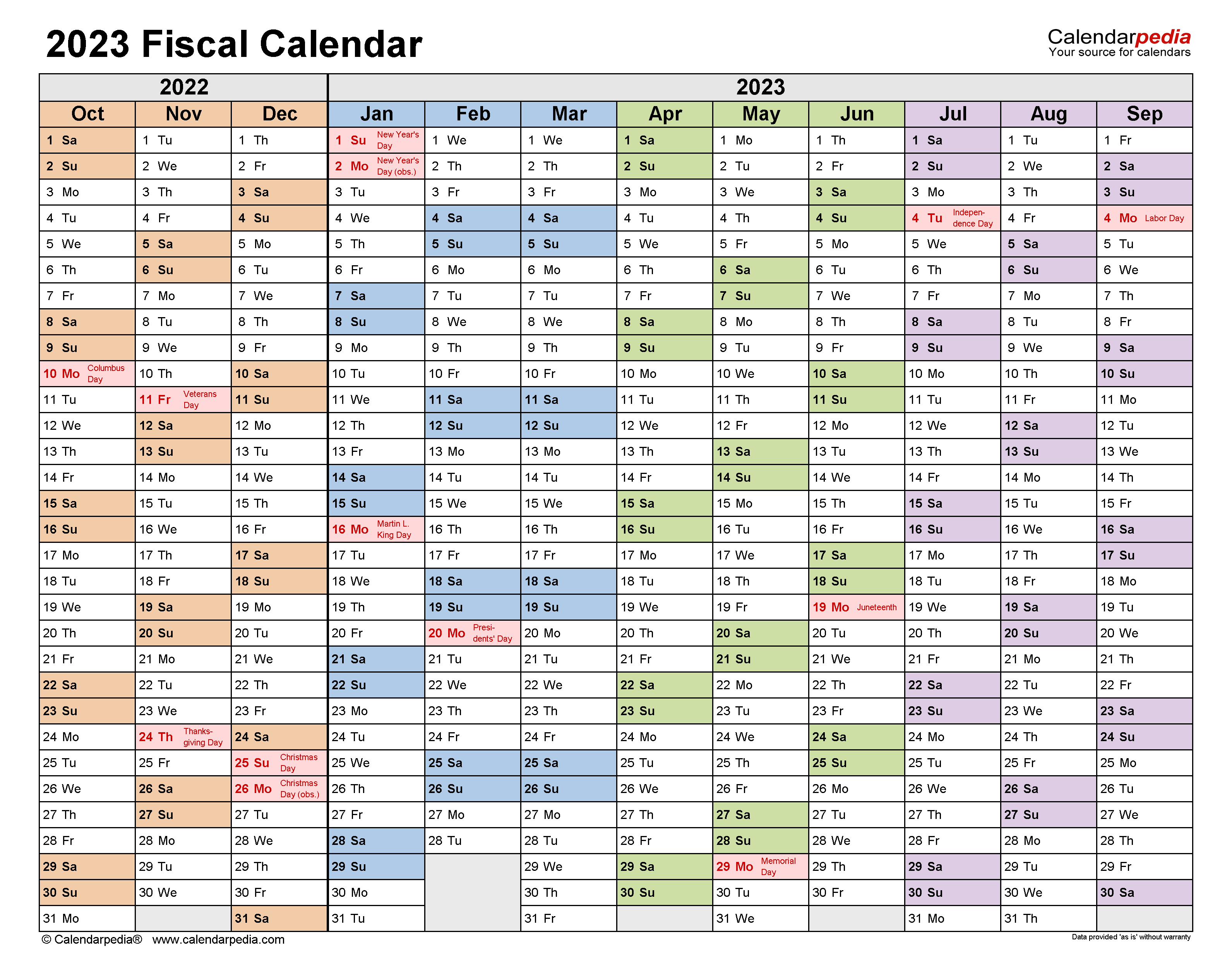

Fiscal Calendars 2023 Free Printable Word Templates

2

Payroll Budget Plan Excel Template Efinancialmodels

Canada Calendar 2023 Free Printable Excel Templates

Fiscal Calendars 2023 Free Printable Word Templates

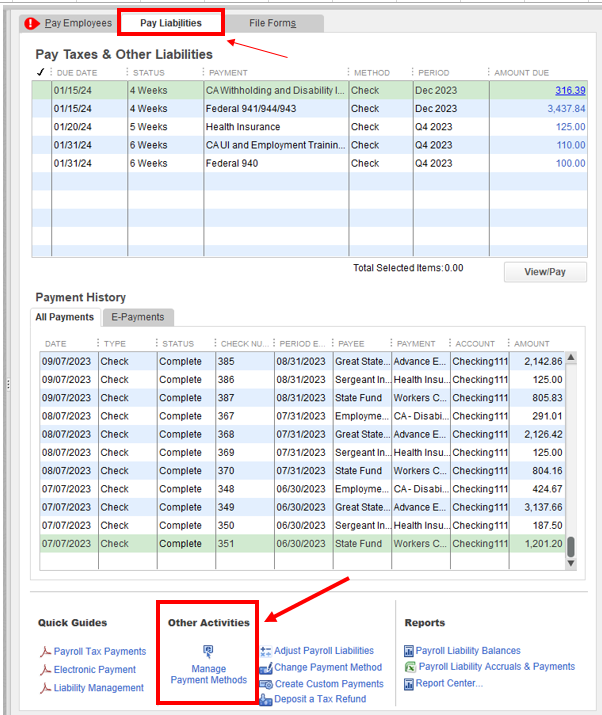

Solved Payroll Liabilities Not Showing For New Employee Deductions Such As Child Support Payments But Wage Garnishment Does Help

2022 2023 Online Payroll Tax Deduction Calculator For 401 K 403 B Plan Withholdings

Commissioned Staff Payroll Budget For Retail Companies Example Uses

Latest Release 2023 Update 1 Release Date 02 March 2022 Announcements News And Alerts Sage Pastel Payroll Sage City Community

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

F9bdnsmkp2rpjm